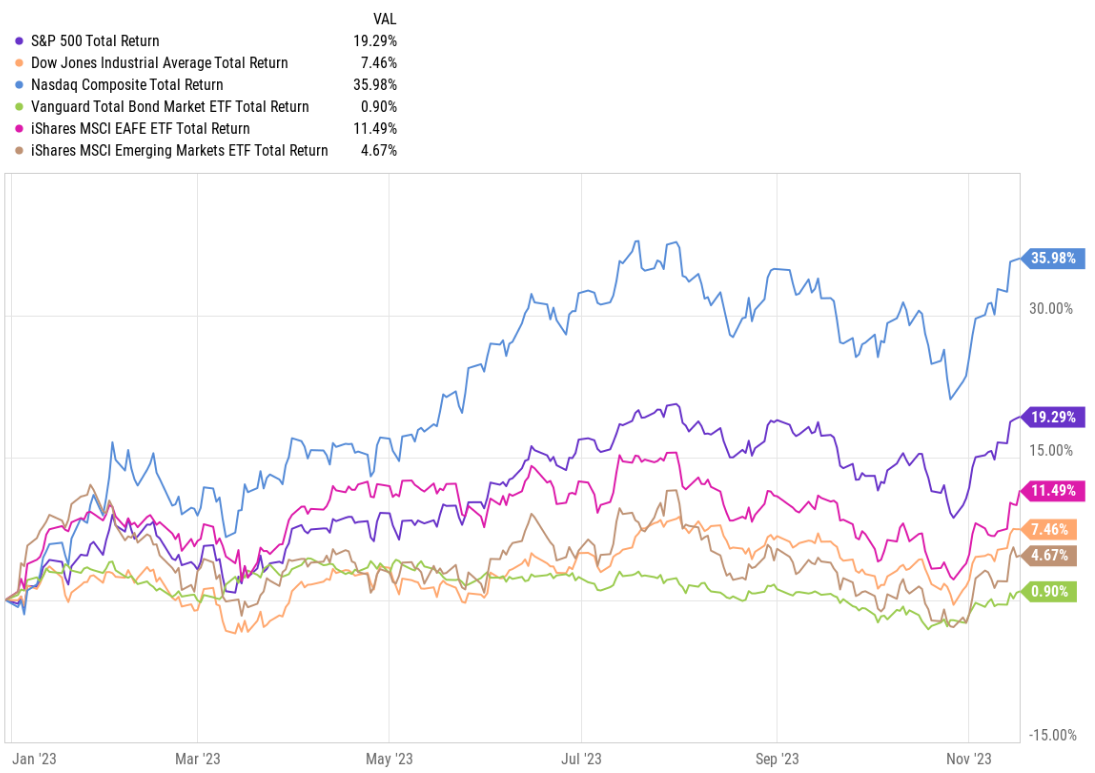

It’s getting to be that time of year so this week I’m updating an earlier post relating to harvesting losses. Even though core bonds have turned positive for the year, this second year in a row of relatively poor performance from bonds may have created some opportunities in your portfolio. You’re probably in good shape in terms of broad market stock funds, but let’s review performance at a high level.

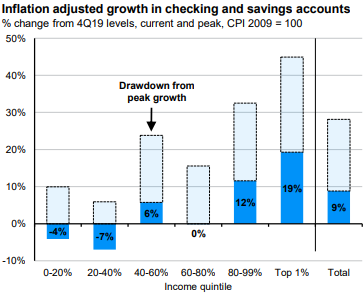

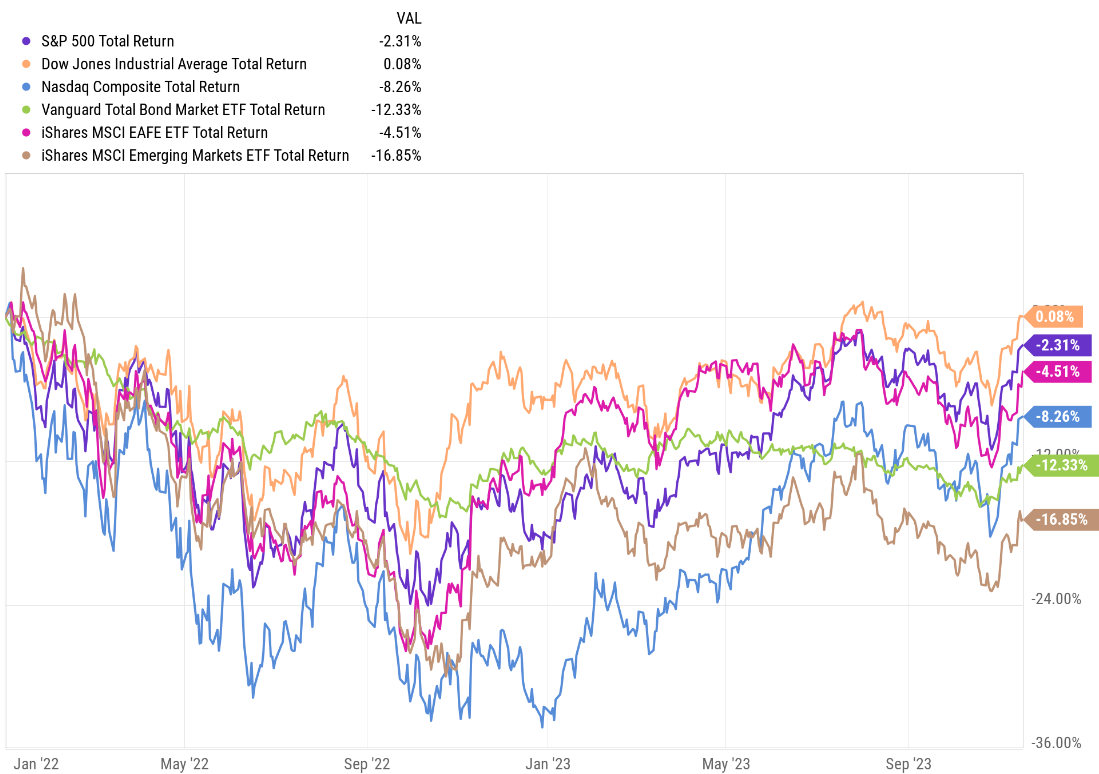

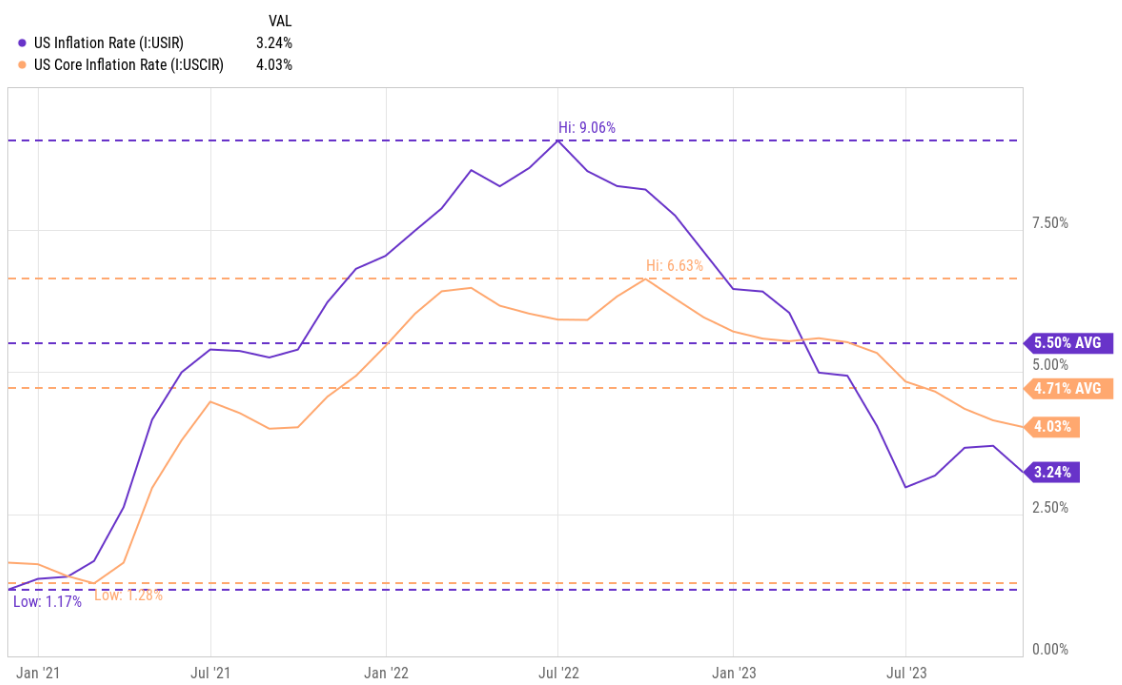

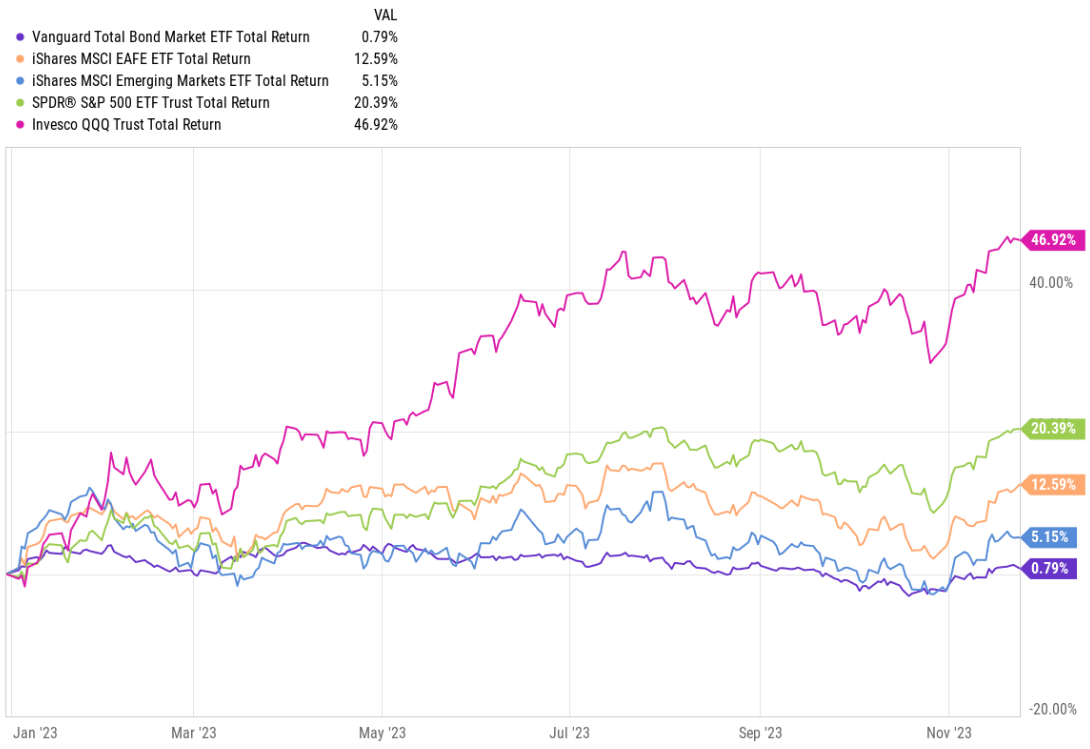

Here’s a chart of five typical index funds to give you an idea of how stocks and bonds have been faring this year. As you can see, and as we discussed recently, performance has been all over the place. Analysis from JPMorgan shows that within the S&P 500, for example, the largest seven stocks are up over 70% year-to-date recovering from a rough 2022 and have contributed over 90% of the index’s performance this year. There’s dispersion in the bond market as well based on issuer type and duration. In short, you may have some unrealized losses during an overall positive year so far.

There are different schools of thought on this, but I think harvesting losses is worthwhile for two reasons: one, if done correctly harvesting losses lowers your household’s tax bill which indirectly increases your investment performance; two, it’s a low to no-cost endeavor. For the most part we don’t have to worry about transaction costs anymore, so the only direct cost is your time. By the way, I think this last point feeds into some of the criticism of harvesting losses. It’s time-consuming and requires holding a lot of details. This hassle factor often makes it difficult for some people, including professional money managers, to want to bother with it.

Here’s a primer on how this works. Ask your tax advisor (or me) for more details. As a reminder, tax loss harvesting only applies to your individual accounts, trust accounts, and so forth, not to your retirement accounts.

First things first – Why do we want to harvest losses?

Losses in our investment accounts are referred to as unrealized, or “paper losses”, until we sell and realize them. Nobody wants to lose money and eventually losses on high quality investments will turn into gains. But it’s possible to reap some benefits from the low points along the way and that’s what loss harvesting is all about.

Say you invested $10,000 in a bond index fund that’s now worth $8,000, for a $2,000 unrealized loss. This is a core holding and the fund is high quality, it’s just down with the market. What should you do?

You could simply hold the investment as a long-term investor should. There’s nothing necessarily wrong with that. But what about that unrealized loss… shouldn’t we try to leverage it in some way? I say yes!

You do this by selling the investment (you can sell a portion but let’s assume you sell the whole thing) and not rebuying it for at least 30 days. You also shouldn’t have bought any shares or reinvested dividends during the prior 30 days. This is tracked by your brokerage firm and creates a 60-day window around whatever date you’re thinking about selling shares. Upon selling you have realized a capital loss and can use it to offset capital gains from other sales in the current calendar year or those pesky year-end taxable mutual fund gain distributions. If you’re doing this multiple times your losses stack together and you can use up to $3,000 as a tax deduction against your income. This makes your realized losses valuable at tax time. Remaining losses carry over until fully used and should show up on Schedule D within your Federal tax return.

While you’re welcome to sit in cash for a month or so after selling the investment, you can and should buy something else while you wait. And this is actually the goal from a portfolio management standpoint – to not rock the boat too much in terms of your investment mix. The tricky part is the new investment is essentially a placeholder that can’t be overly similar to what you just sold or you risk triggering a wash sale that invalidates your loss. This applies to all of your family’s accounts. No selling in yours and buying back immediately in your spouse’s account or selling in your brokerage account and then immediately buying back in your Roth IRA, for example.

The details get complicated, but a simple approach to finding a placeholder is to change management style or regions. For example, if you’re selling a passively managed broad market ETF like Vanguard Total Bond Market, ticker symbol BND, you could use an actively managed mutual fund that owns US bonds. Or you could use a California municipal bond fund (assuming you’re in CA). It’s not a perfect match and can’t be anyway but keeps you invested. That way if markets rise during the month or so while you’re out of BND you’re still getting some benefit. And if you own BND in multiple accounts, remember that you’re only selling shares in your non-retirement account, so you still have exposure to core bonds, just less for a while. Worse case, you’ll have some gain when you sell your placeholder that uses up some of your harvested loss. But that’s a great problem to have, right? Maybe markets continue to fall and you harvest more losses when moving back into your original investment. Or maybe you decide to keep your placeholder for a while – there’s no rule requiring a roundtrip.

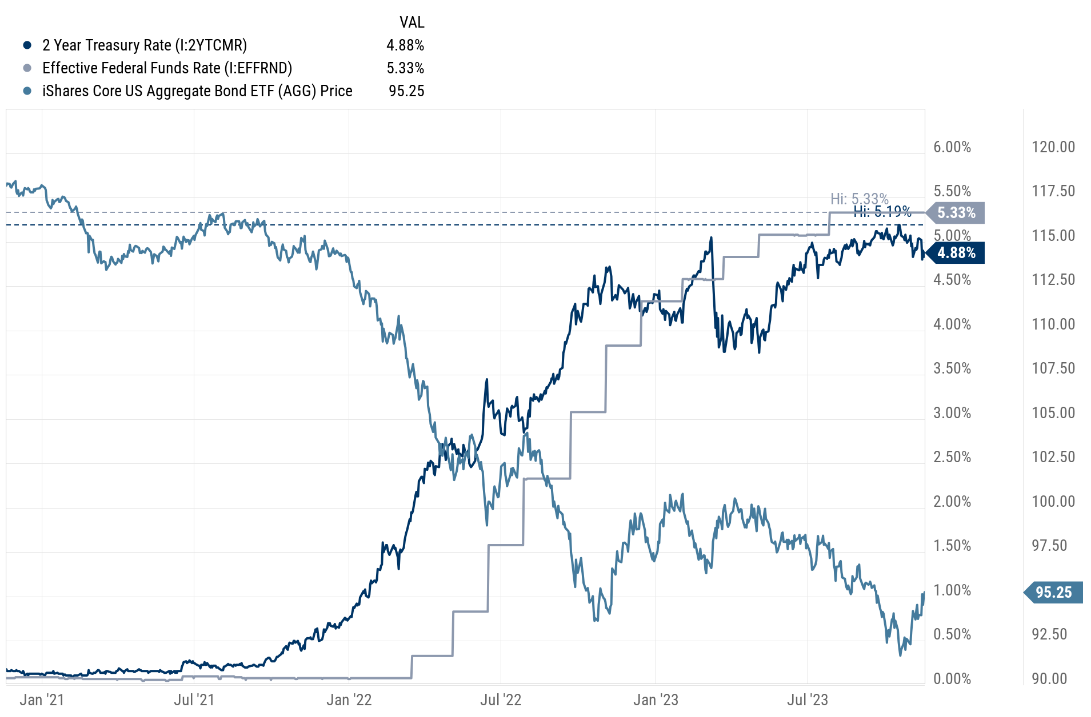

Regarding bond placeholders, yields on money market funds and short-term CDs are still good. Schwab’s Value Advantage Money Market Fund is currently yielding about 5.2%, for example, and FDIC-insured bank CDs maturing in December and January are paying a similar annual rate. So while I ordinarily try to reinvest proceeds from harvesting losses into something similar to maintain market exposure, I think these cash equivalents are a good and simple option right now if you’re harvesting from bond funds.

Again, there’s a lot of detail here and I’ve just scratched the surface. The point is that if you haven’t harvested this year I highly suggest taking a look at your unrealized gain and loss information prior to year-end. Or if you harvested losses months ago, take another look. Maybe doing nothing is better for you right now but at least you’re making an informed decision.

And you don’t have to worry about these details if we’re managing your portfolio – we’ve got you covered.

Have questions? Ask us. We can help.

- Created on .